Have you ever thought of

something which has given an unbelievable returns but still was not as risky as

its peers. I can hear your mindset where it says "I know you are going to

talk yet again about a chit fund company which conned us a decade ago or about

an MLM company".

All I can say in one word is a

big NO!!

I am not going to speak about any

of the above aspects. Having been in the banking field for close to a decade

with a accounts degree, I have had the privilege to work as an unpaid Financial

Planning Manager(FPM) for my colleagues back in my previous company thereby

saving few thousands of rupees as taxes for them. I never had thought about

hiring a chartered accountant to plan my finances since I was salaried back

then and with limited resources, I planned my finances carefully and ensured

that I paid minimum taxes as mandated by the Law.

Having switched my profession now

from being an employee to a self employed consultant in the professional

capacity, my scope had widened with unlimited avenues to income earning

potential with a equal burden of tax. It was then I decided to move away from

the traditional investments like Insurance, Metals, Deposits to name a few.

I wouldn't deny the fact that

these investments came at a cost which involved lot of sacrifice and sweat that

saw my earnings gone into various schemes but was I happy with all of them?

Honestly speaking, I wasn't. While some were done for the last minute pressure

to avoid taxes, some were done for the sake of recommendation and friendship

but yes, I do realize that when it comes to investment, emotional things must

be kept aside.

Well, I have no regrets for what

had happened in the past which cannot be undone but the present action can

always be rectified to ensure that all my investments further would not only

reflect my true potential but also ensure that I got the maximum returns. Now

going back to the very first para on this. I was saying about maximum returns.

How much percentage does your bank promise on deposits?

4,5,6,7,8? while it is 3%

minimum, it goes upto a maximum of 8% on a normal savings accounts and little

over 10% for long term fixed deposits. Again these are taxable at the time of

maturity and with the inflation that needs to be taken into consideration, the

end result would put you in minus. We do not think about it most of the time.

While I am not completely critical on this aspect since few do this way as it

is convenient for them or they are averse to consider other options or they may

not be aware of some of the greatest options available.

Now this is where, ARQ comes into

picture. What is ARQ and what makes it unique compared to others?

ARQ is a revolutionary automated investment

engine that takes emotional bias out of investing and let's you harness the

maximum performance of equities as an asset class, ARQ offers recommendations

for Mutual Funds (Lumpsum & SIP) and Equity Stocks. It is accessible to all

Angel Broking Customers via Angel Eye or the Angel Broking App. ARQ's

performance test results are available for you to examine, before you take the

plunge with your hard-earned money. ARQ’s advisory is based on a model whose

performance has been optimized to provide recommendations with high

outperformance and strike rates. The model has been tested using scientific

back-testing and has also been validated based on its track record. The model

has been calibrated to take advantage of the upticks in the stocks or mutual

funds during an investment period.

As you could see from the above,

ARQ is an unique app that helps you in making the investment in a planned way

which is a tried and tested method and has been validated as well based on its

track record.

To make you understand in a

simple way, let us take this example.

We all were talking bit about BSE

hitting all time high benchmarks in the recent times. An analysis shows that it

started at 100 on 12th May 2016 and ended at 122.7 on 30th June 2017 which is

an impressive increase of 22.7 over a period of little over a year.

Now consider the ARQ Index. It

also started at 100 on 12th May 2016 and ended at 138.2 on 30th June 2017. Now

that's an increase of 38.2% which by all means is even better than the

exorbitant credit card rates(kindly note that I am not advocating using your

credit card to rotate funds and getting higher returns because unless you clear

the credit card balance within the revolving credit time period, their interest

rates are even higher).

Few more analysis will make you

understand this even better. I am going to compare few of them with BSE 100 and

a single product with Nifty Midcap 100. The time period used to come to this

reference is between May'16 to Jun'17

ARQ Fundamental Winners

|

BSE100

|

ARQ MidCap Stocks

|

Nifty Midcap 100

|

14.1%

|

7%

|

38.9%

|

31.9%

|

ARQ Quality Stocks

|

BSE 100

|

ARQ Value Stocks

|

BSE 100

|

24.0%

|

11.8%

|

24.0%

|

11.8%

|

As you could see from the above,

the difference in terms of returns are clearly evident. While there are no human interventions

involved in the usage of this app which eliminates even the single possibility

of error being committed since all the calculations were based on previous

performances and records, this also ensures that you get the best and trusted

advice when it comes to investing your hard earned money.

Now you will see as to how the

ANGEL BROKING app which is available on iOS and Google Playstore has helped me

to plan my finances.

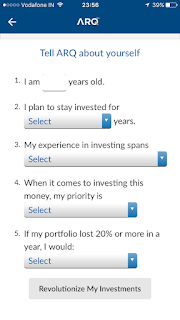

Then I went ahead with the

Questionnaire.

Based on my answers, I was given

few more questions with choice of answers given.

All I or any one for that case

needs to do is to be honest and fill the questionnaire.

As you could see from the above,

I entered the answers which were true to my knowledge.

I was immediately given the

option of what my investments need to be. Kindly note that the recommendations

were based on NOBEL PRIZE winning Modern Portfolio Theory.

Based on my answers, I was given

the above mentioned Asset Allocation Portfolio which I selected. As you could

see, my traditional investments on metals has not found any significance in

this with due weightage given to Equity MF followed by Debt MF.

Needless to say, I was happy and

went ahead with the plan for the fact that knowledge is unlimited and we are

always in the process of learning and when you have proper guidance available,

the best and wisest thing is to make use of it.

ARQ is the brainchild of Angel Broking which is a member of BSE,

NSE and also with NCDEX and MCX. Catering to the needs of more than 1 Million

retail investors, it has a nationwide network of 132 branches with 17 regional

hubs and more than 9000 registered sub-brokers/business associates with 3500+

employees across India .

With the advent of GST and

increase in tax rates on most of the products, it wouldn't be wise, if you have

not acted upon your investment planning which would not only help you secure

your own future but also the future of your entire family as well.

1 comments:

பங்கு சந்தையில் கலந்து கொள்ள விரும்புகிறேன்

EmoticonEmoticon